Ace Info About How To Quickly Pay Off Credit Card Debt

Skip the bank & save!

How to quickly pay off credit card debt. You’ll find your full balance on your. According to fitch ratings, the average credit card debt per household is $15,788, according to creditcards.com. Always keep in mind that lower interest rates make it easier to pay off debt.

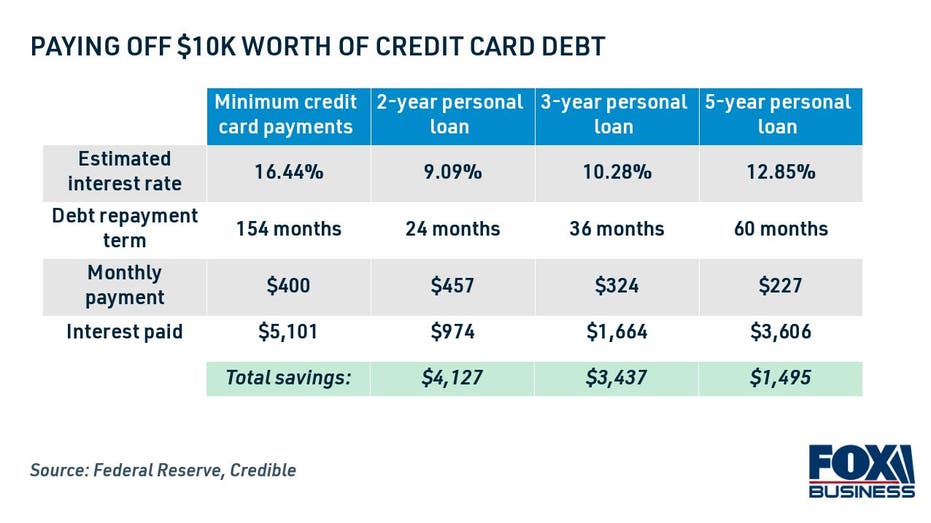

Take out a debt consolidation loan. Even an extra $25 a month can make a huge difference to the bottom line of your debt, cutting hundreds or even thousands in interest payments, not to mention taking. Get instantly matched with the best personal loan option for you.

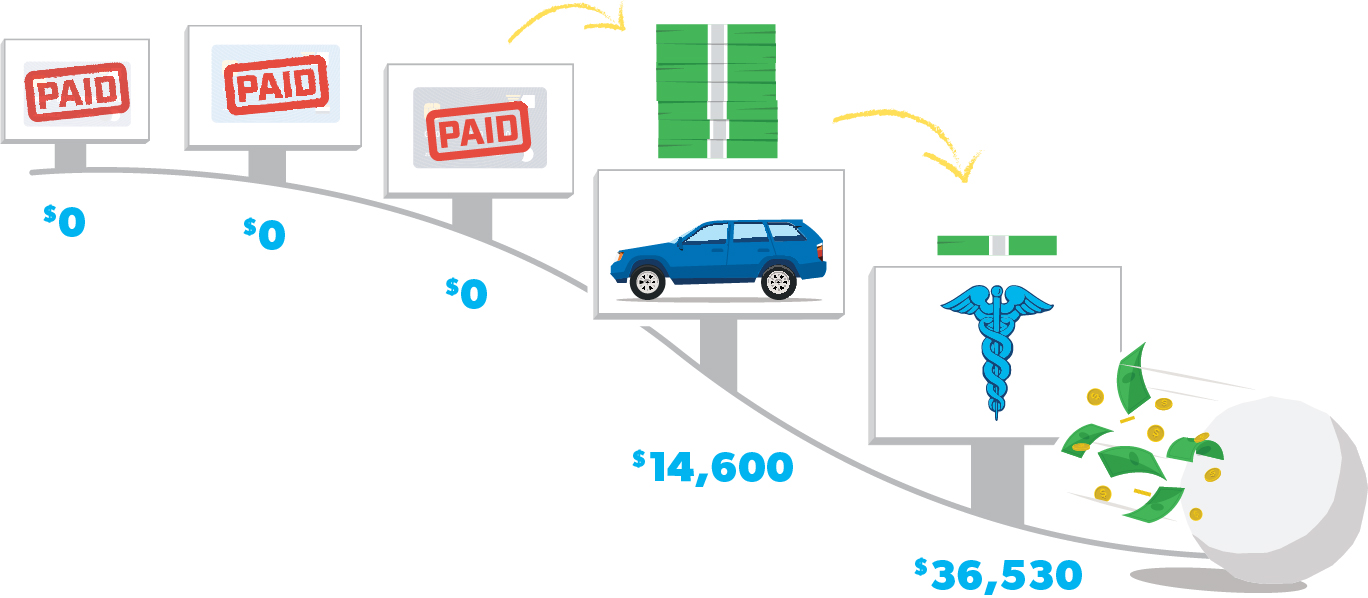

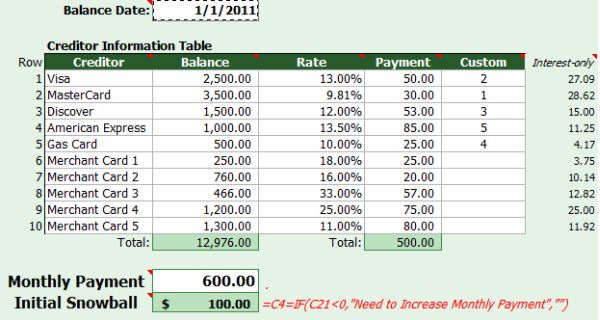

According to my credit score, i owe. Using the debt snowball, you'll pay off the smallest balances first; Seek help through debt relief.

Know your options with aarp money map. A lower rate means less of each monthly payment you make gets eaten up by accrued interest. Ad get helpful advice and take control of your debts.

This can help you save money on interest, where you can pay off credit cards debt more quickly. The best way to pay down that debt as quickly as possible is to. Many of us feel that paying off that credit card debt is very difficult and no matter how hard you try, it just won't go away.

If you owe $10,000 on your credit card with an interest rate of 18% and make minimum monthly payments of $200 (using 2% of the balance), it will take you more than 50. According to my credit score, i owe around $12,723, and i plan on paying off in less than 6 months, although i could pay it off in one payment. Use a balance transfer credit card.